Google Stock: A Comprehensive Guide To Investing In One Of The Tech Giants

Mar 21 2025

In today's dynamic financial landscape, Google stock has emerged as one of the most sought-after investments for both seasoned investors and newcomers alike. As one of the leading technology companies globally, Google has consistently demonstrated its ability to innovate, adapt, and deliver impressive financial performance. For those looking to grow their wealth or diversify their portfolios, understanding Google stock is essential. This article will delve into everything you need to know about investing in Google stock, from its history to current trends and future potential.

Whether you're a day trader or a long-term investor, Google stock offers exciting opportunities. The company's robust financial health, coupled with its dominance in digital advertising, cloud computing, and artificial intelligence, makes it a standout player in the tech industry. In this guide, we'll explore why Google stock is worth considering and provide actionable insights to help you make informed investment decisions.

As you read further, you'll uncover key metrics, strategies, and expert advice to navigate the complexities of investing in Google stock. Our goal is to equip you with the knowledge and confidence needed to potentially capitalize on this lucrative investment opportunity. So, let's dive in!

Read also:Gel Band The Ultimate Guide To Fitness Tracking And Health Monitoring

Table of Contents

- History of Google Stock

- Key Financial Metrics of Google Stock

- Google's Market Position and Competitors

- Growth Drivers of Google Stock

- Risks Associated with Google Stock

- Investor Strategies for Google Stock

- Future Prospects and Predictions

- Expert Opinions on Google Stock

- Comparison with Other Tech Stocks

- Frequently Asked Questions about Google Stock

History of Google Stock

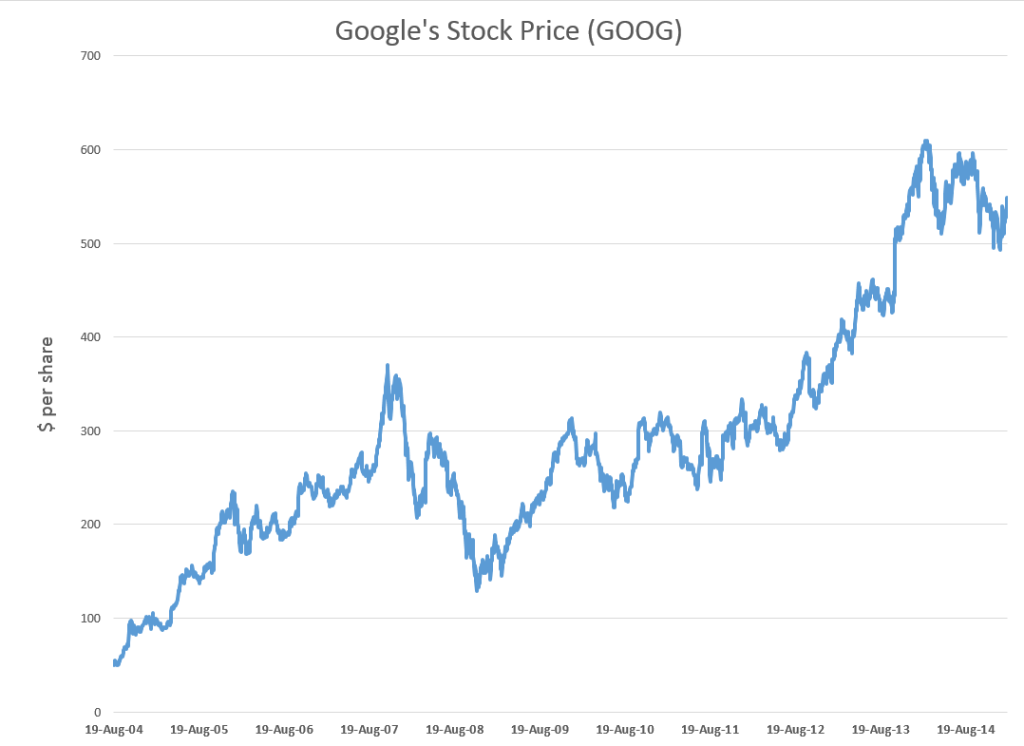

Google's journey in the stock market began on August 19, 2004, when it officially went public through an initial public offering (IPO). At the time, the company sold shares at $85 each, raising approximately $1.9 billion. Since then, Google stock has undergone significant transformations, including the reorganization into Alphabet Inc. in 2015. This restructuring aimed to streamline operations and enhance transparency, allowing investors to better understand the company's diverse business units.

Key Milestones in Google Stock's History

Throughout its tenure, Google stock has achieved several milestones that have shaped its trajectory:

- 2007: Google surpassed Microsoft in market capitalization, marking a turning point in the tech industry.

- 2013: The stock price hit $1,000 for the first time, reflecting the company's growing influence and financial strength.

- 2018: Google's parent company, Alphabet, became one of the first U.S. companies to reach a $1 trillion market cap.

These achievements underscore Google's ability to deliver consistent value to shareholders, making it a staple in many investment portfolios.

Key Financial Metrics of Google Stock

Understanding the financial health of Google stock requires a closer look at its key metrics. These figures provide valuable insights into the company's performance and potential for growth.

Revenue Growth

Google's revenue has consistently grown over the years, driven by its core advertising business and expanding cloud services. In 2022 alone, Alphabet reported a revenue of $283 billion, representing a year-over-year increase of 10%.

Earnings Per Share (EPS)

Earnings per share (EPS) is another critical metric for evaluating Google stock. In 2022, Alphabet's diluted EPS was $96.87, reflecting strong profitability despite economic challenges.

Read also:Philly Is A Natural As The Host Of The Ncaa Wrestling Championships Heres Why

Price-to-Earnings Ratio (P/E)

The P/E ratio helps investors assess whether Google stock is undervalued or overvalued. As of early 2023, Alphabet's P/E ratio stood at approximately 23, which is relatively low compared to other tech giants, indicating potential for further growth.

Google's Market Position and Competitors

Google dominates the digital advertising market, capturing over 28% of global ad spend. Its search engine remains the most visited website globally, ensuring a steady stream of revenue. However, the company faces stiff competition from other tech giants like Meta (formerly Facebook) and Amazon.

Competitive Advantage

Google's competitive advantage lies in its innovative technology, vast user base, and robust data analytics capabilities. These factors enable the company to maintain its leadership position while exploring new opportunities in emerging fields like artificial intelligence and quantum computing.

Growth Drivers of Google Stock

Several factors contribute to the growth potential of Google stock:

Artificial Intelligence (AI)

Google is at the forefront of AI development, investing heavily in research and applications. AI-powered products like Google Assistant and autonomous driving technologies are expected to drive future revenue streams.

Cloud Computing

Google Cloud continues to expand its market share, offering scalable solutions for businesses of all sizes. With increasing adoption of cloud services globally, this segment is poised for substantial growth.

Mobile Advertising

As mobile usage continues to rise, Google's mobile advertising platform remains a key revenue driver. The company's ability to adapt to changing consumer behaviors ensures sustained profitability in this space.

Risks Associated with Google Stock

Despite its strengths, investing in Google stock comes with inherent risks:

Regulatory Challenges

Google faces increasing scrutiny from regulators worldwide due to antitrust concerns. Potential fines or restrictions could impact its operations and profitability.

Economic Downturns

During economic slowdowns, advertising budgets often get slashed, affecting Google's primary revenue source. Investors must remain vigilant about macroeconomic trends.

Technological Disruptions

Rapid technological advancements pose a risk to Google's dominance. Competitors may introduce disruptive innovations that challenge its market position.

Investor Strategies for Google Stock

Investors looking to capitalize on Google stock should consider the following strategies:

Long-Term Investment

Given Google's strong fundamentals and growth prospects, a long-term investment approach is advisable. Holding the stock for several years allows investors to benefit from compounding returns.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount regularly, regardless of market conditions. This strategy reduces the impact of volatility and ensures consistent portfolio growth.

Technical Analysis

For traders seeking short-term gains, technical analysis can help identify entry and exit points based on price patterns and indicators.

Future Prospects and Predictions

Looking ahead, Google stock is expected to continue its upward trajectory. Analysts predict that advancements in AI, cloud computing, and digital advertising will propel the company to new heights. By 2030, Alphabet's market capitalization could surpass $2 trillion, solidifying its status as a dominant force in the tech industry.

Expert Opinions on Google Stock

Industry experts remain bullish on Google stock. According to a report by Bloomberg Intelligence, Alphabet is well-positioned to capitalize on emerging trends in technology and advertising. Similarly, analysts at J.P. Morgan have assigned a "buy" rating to the stock, citing its strong financials and growth potential.

Comparison with Other Tech Stocks

When compared to peers like Apple, Microsoft, and Amazon, Google stock offers a unique blend of growth and stability. While Apple dominates the consumer electronics space, and Amazon leads in e-commerce, Google's focus on digital advertising and AI sets it apart. This diversification makes it an attractive option for investors seeking exposure to multiple sectors.

Frequently Asked Questions about Google Stock

Q1: Is Google stock a good investment?

Yes, Google stock is considered a solid investment due to its strong financial performance, innovative products, and leadership in key industries.

Q2: How much does one share of Google stock cost?

As of early 2023, one share of Google stock (Class A) trades around $95 per share, following a 20-for-1 stock split in 2022.

Q3: What are the risks of investing in Google stock?

Risks include regulatory challenges, economic downturns, and technological disruptions. However, these risks are mitigated by Google's robust business model and adaptability.

Conclusion

In summary, Google stock presents a compelling investment opportunity for those seeking growth and stability. With its dominant market position, innovative technologies, and strong financials, the company is well-equipped to navigate future challenges and capitalize on emerging trends. We encourage readers to conduct thorough research and consult financial advisors before making investment decisions.

Take action today by exploring Google stock further and sharing your thoughts in the comments below. Don't forget to check out our other articles for more insights into the world of finance and investing!