Nvidia Shares Fall Following New AI Chip Announcements: A Comprehensive Analysis

Mar 19 2025

Nvidia shares fall following new AI chip announcements has become a trending topic in the tech and financial world. The semiconductor giant, known for its cutting-edge innovations in artificial intelligence (AI) and graphics processing units (GPUs), has recently made headlines with its latest product releases. However, these announcements have sparked mixed reactions among investors, leading to fluctuations in the company's stock prices. In this article, we will delve into the reasons behind the decline in Nvidia's shares, analyze the implications of the new AI chip announcements, and explore the broader market dynamics at play.

Nvidia's dominance in the AI hardware sector is undeniable, with its GPUs being the preferred choice for developers and researchers worldwide. The company's commitment to innovation and technological advancement has consistently driven its growth. However, as with any major corporate announcement, there are always risks and uncertainties that can impact investor sentiment. In this context, understanding why Nvidia shares fell after the AI chip announcements becomes crucial for stakeholders and market observers.

This article aims to provide a detailed analysis of the situation, offering insights into the financial performance of Nvidia, the impact of its latest AI chips on the market, and the potential long-term implications for the company and its investors. By examining both the technical and financial aspects, we aim to equip readers with a comprehensive understanding of the events unfolding in the tech industry.

Read also:Tre Johnson The Rising Star In The Music Industry

Daftar Isi

- Overview of Nvidia and Its Role in the AI Market

- Recent AI Chip Announcements by Nvidia

- Market Reaction to the Announcements

- Nvidia Shares Performance Analysis

- Financial Impact on Nvidia

- Understanding Investor Sentiment

- Competitor Analysis in the AI Chip Market

- Future Prospects for Nvidia

- Expert Opinions and Market Predictions

- Conclusion and Call to Action

- Subheading: The Role of AI in Nvidia's Growth

- Subheading: Key Features of the New AI Chips

- Subheading: Factors Affecting Share Prices

- Subheading: Long-Term Implications for Investors

- Subheading: Nvidia's Competitive Edge

- Subheading: Risks and Opportunities in the AI Sector

Overview of Nvidia and Its Role in the AI Market

Nvidia Corporation is a global leader in the semiconductor industry, renowned for its development of graphics processing units (GPUs) and AI technologies. Established in 1993, the company has consistently pushed the boundaries of innovation, transforming the way we interact with technology. Nvidia's GPUs are widely used in gaming, data centers, autonomous vehicles, and AI applications, making it an indispensable player in the tech ecosystem.

As the demand for AI-driven solutions continues to grow, Nvidia has positioned itself at the forefront of this revolution. The company's GPUs are designed to handle complex computations required by machine learning models, enabling faster and more efficient processing. This has cemented Nvidia's role as a key enabler of AI innovation, attracting significant attention from investors and tech enthusiasts alike.

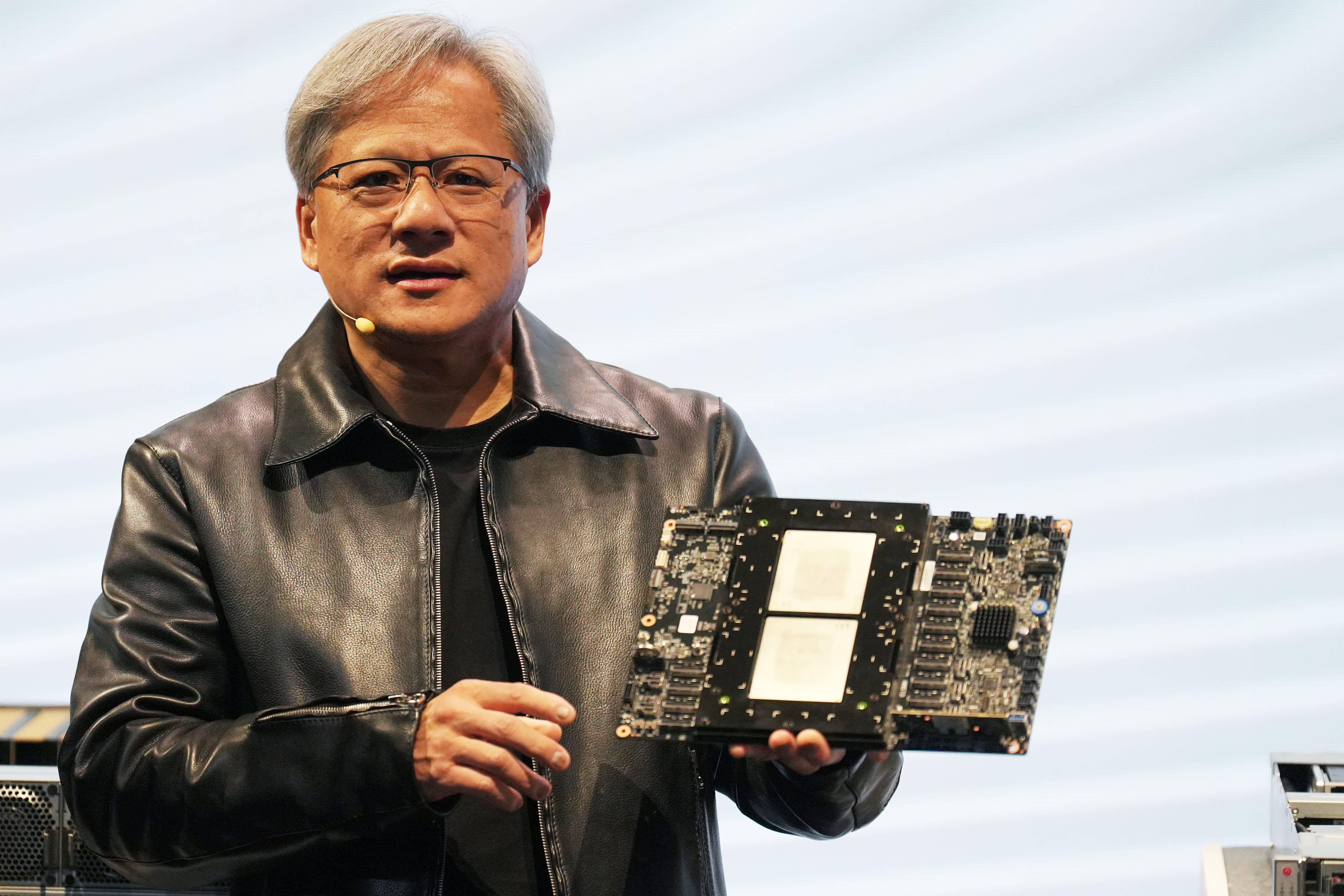

Recent AI Chip Announcements by Nvidia

In its latest product unveiling, Nvidia introduced a series of advanced AI chips aimed at enhancing performance in various applications. These chips, designed with cutting-edge technology, promise to deliver unprecedented speed and efficiency. Some of the key features include enhanced tensor cores, improved memory bandwidth, and optimized power consumption.

The Role of AI in Nvidia's Growth

Artificial intelligence has played a pivotal role in Nvidia's growth trajectory. By focusing on AI-specific hardware, the company has carved out a niche market that continues to expand. The new AI chips are expected to further solidify Nvidia's position as a leader in this space, offering solutions tailored to the needs of modern businesses and researchers.

Market Reaction to the Announcements

The market's response to Nvidia's AI chip announcements has been mixed. While some investors have praised the company's continued innovation, others have expressed concerns about the potential impact on profitability. The introduction of new products often requires significant investment, which can temporarily affect financial performance. This has led to fluctuations in Nvidia's share prices, reflecting the uncertainty surrounding the company's future earnings.

Read also:March Madness 2025 Bracket Ncaa Tournament Picks Predictions By Toptier College Basketball Model

Key Features of the New AI Chips

- Enhanced tensor cores for faster AI computations

- Increased memory bandwidth for improved data throughput

- Optimized power consumption for energy efficiency

- Advanced architecture designed for deep learning applications

Nvidia Shares Performance Analysis

Analyzing Nvidia's share performance provides valuable insights into the market's perception of the company. Over the past few months, Nvidia's stock has experienced both gains and losses, influenced by a variety of factors. The recent fall in shares following the AI chip announcements highlights the importance of investor sentiment in determining stock prices. While short-term volatility is common, long-term trends indicate a positive outlook for Nvidia's growth prospects.

Factors Affecting Share Prices

Several factors contribute to the fluctuations in Nvidia's share prices, including:

- Economic conditions and global market trends

- Technological advancements and competition in the AI sector

- Investor confidence and market sentiment

- Corporate earnings reports and financial performance

Financial Impact on Nvidia

The financial impact of the new AI chip announcements on Nvidia is multifaceted. While the initial investment required for research and development may lead to short-term financial challenges, the long-term benefits of enhanced product offerings are expected to outweigh these costs. Nvidia's strong financial position, coupled with its robust pipeline of innovative products, positions the company well for future success.

Long-Term Implications for Investors

For investors, the long-term implications of Nvidia's AI chip announcements are significant. While the current dip in share prices may raise concerns, historical data suggests that Nvidia's ability to adapt and innovate often translates into sustained growth. Investors who focus on the company's strategic vision and technological leadership are likely to benefit from its future endeavors.

Understanding Investor Sentiment

Investor sentiment plays a crucial role in shaping stock prices. In the case of Nvidia, the mixed reactions to the AI chip announcements reflect the complexities of the modern financial market. While some investors view the new products as a catalyst for growth, others remain cautious due to the uncertainties associated with technological disruptions. Understanding these dynamics is essential for making informed investment decisions.

Nvidia's Competitive Edge

Nvidia's competitive edge lies in its ability to combine cutting-edge technology with a deep understanding of market needs. The company's focus on AI innovation has enabled it to stay ahead of competitors, offering solutions that meet the evolving demands of businesses and consumers. This strategic approach has been instrumental in maintaining Nvidia's leadership position in the semiconductor industry.

Competitor Analysis in the AI Chip Market

In the highly competitive AI chip market, Nvidia faces challenges from several key players, including AMD, Intel, and Qualcomm. Each of these companies brings its own strengths to the table, making the competition intense. However, Nvidia's expertise in GPU technology and its commitment to AI innovation provide a distinct advantage. By continuously improving its product offerings, Nvidia aims to maintain its dominance in the market.

Risks and Opportunities in the AI Sector

The AI sector presents both risks and opportunities for companies like Nvidia. While the potential for growth is immense, the rapid pace of technological change requires constant adaptation. Companies that fail to innovate risk falling behind in a market driven by cutting-edge solutions. Nvidia's proactive approach to addressing these challenges positions it well for future success.

Future Prospects for Nvidia

Looking ahead, Nvidia's prospects remain promising. The company's focus on AI innovation, coupled with its strong financial position, sets the stage for continued growth. As the demand for AI-driven solutions continues to rise, Nvidia's ability to deliver cutting-edge products will be key to its success. By staying ahead of the curve, Nvidia is well-positioned to capitalize on the opportunities presented by the evolving tech landscape.

Expert Opinions and Market Predictions

Experts in the tech and financial sectors have weighed in on Nvidia's recent AI chip announcements, offering diverse perspectives on the company's future. Analysts from reputable firms such as Morgan Stanley and Goldman Sachs have highlighted the potential for Nvidia to drive growth through its innovative products. While acknowledging the challenges ahead, these experts remain optimistic about the company's long-term prospects.

Conclusion and Call to Action

In conclusion, the recent fall in Nvidia shares following new AI chip announcements reflects the complexities of the modern financial market. While short-term volatility is a concern, the long-term outlook for Nvidia remains positive. The company's commitment to innovation and its leadership in the AI sector position it well for future success. We encourage readers to stay informed about Nvidia's developments and consider the implications for their investment strategies.

We invite you to share your thoughts and insights in the comments section below. Your feedback is valuable in helping us understand the market dynamics and provide better content for our readers. Additionally, explore other articles on our website to stay updated on the latest trends in the tech and financial industries.